Taxation & Filing

About Taxation & Filing

All individuals and organizations significantly involved in the activity of trade or commerce are subject to taxes levied by respective authorities. In many instances, multiple forms of taxes may be levied on the entity/individual by the taxing authority. Taxation is of two types. (i) Direct taxation, which include taxes like Income tax, wealth tax, etc, and (ii) Indirect taxation like GST, Customs, etc.

Failure in compliance could result in various penalties and increased exposure to civil actions. In the current global economic scenarios with companies having a multi-geographical presence, tax compliance is required with not one but multiple taxation authorities.

Our Service Offerings

At Oremus, we understand regulatory requirements applicable to each entity/individual and come up with solutions for its adherence by our clients. Some areas of expertise in our team include but are not limited to,

- Review of TDS and GST liabilities

- Quarterly filing of E-TDS Returns

- GST Registrations

- Monthly/Quarterly/Annual filings of GST Returns

- Estimation of Advance Tax Payments

- Filing of Annual Income Tax Returns

- Coordination and support for tax audits and replying to notices

- Support for Global Taxation (U.S & U.K)

- Operational Tax planning.

Why Taxation & Filing?

It becomes indispensable for an organization to understand its taxing environment and critical to its continued success to answer the following:

Awareness: Is the entity aware of all taxes that are applicable to it?

Registration: What is the procedure to register with the relevant authority?

Obligation: If taxes are applicable, what are the tax obligations that the entity needs to compensate?

Exemptions: Is the entity eligible for any exemptions?

Liability: How often are the taxes required to be paid?

Reporting: What and how is the information associated with transactions required to be submitted to the taxing authority?

Compliance with taxation and filing requirements are a sequence; any transaction being different in nature needs to be evaluated for listed criteria and more.

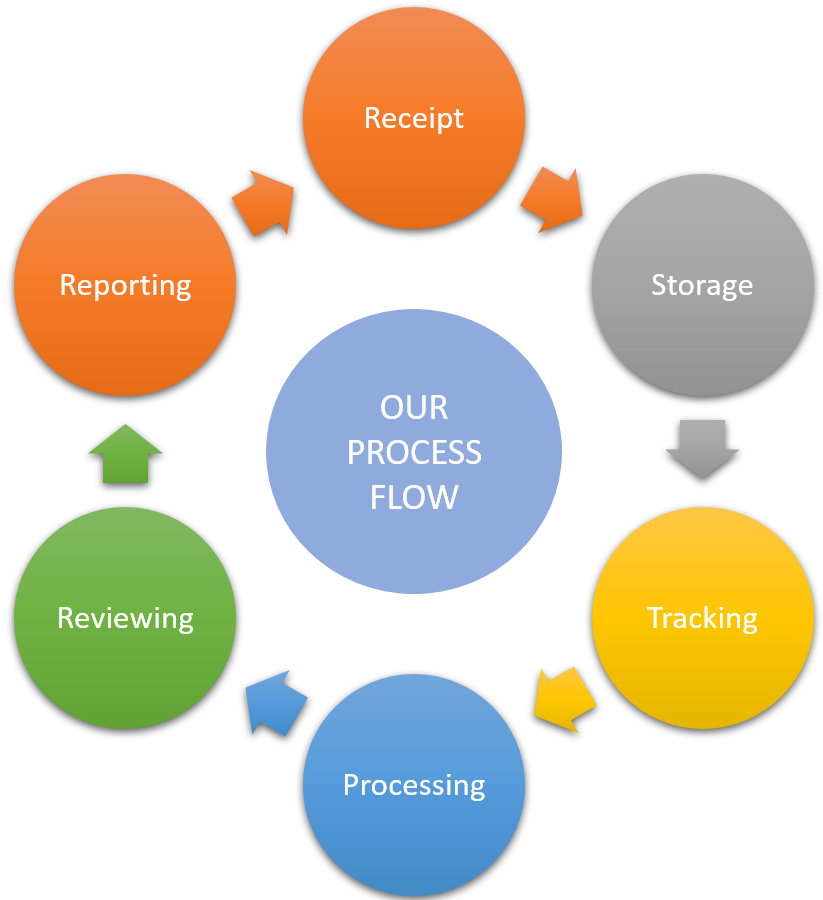

How we do?

Transaction Processing

Accounting & Bookkeeping

Custom Reporting

Payroll Management

Compliance